how to find operating income

Operating Income Formula (Table of Contents)

- Operating Income Formula

- Examples of Operating Income Formula (With Excel Template)

- Operating Income Formula Calculator

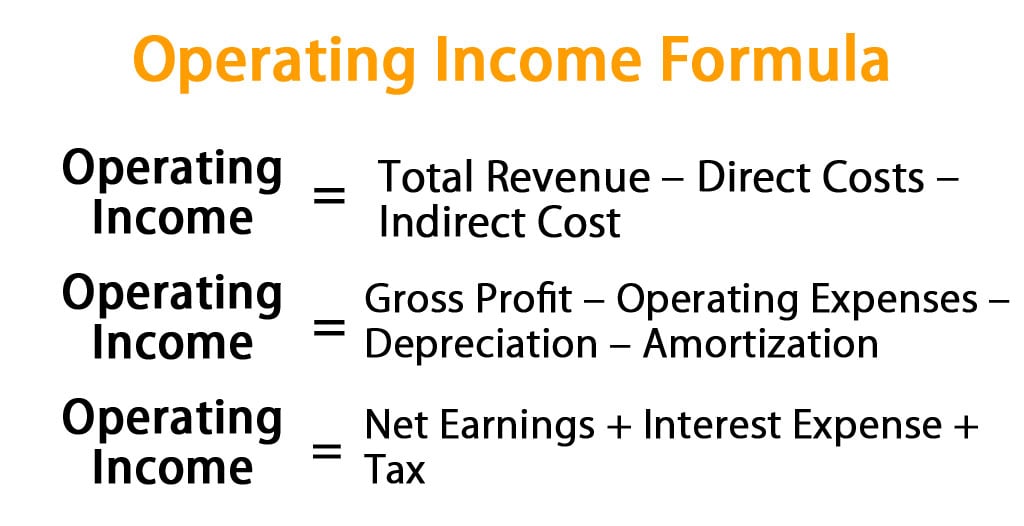

Operating Income Formula

Operating income is sales revenue minus operational direct and indirect cost. It is also known as operating profit or Earnings before interest and taxes (EBIT). Operating income is a measure of profitability that is generated from operations. This profitability tells how much revenue will become profitable in a company. It indirectly measures the efficiency of a company. With the increase in operating income, the profitability of the company's core business also increase. There are multiple formulas to calculate operating income depending on values available of the different financial element they are as follows:

- Operating income is total revenue minus direct costs minus indirect costs. This formula is used when direct cost and indirect cost is available for the company.

Operating Income = Total Revenue – Direct Costs – Indirect Cost

- Operating Income is gross income less depreciation less operating expense less amortization. This formula is applicable when the value of gross profit operating expense, the value of depreciation and amortization is available.

Operating Income = Gross Profit – Operating Expenses – Depreciation – Amortization

- Operating Income is the sum of net earnings, interest expense, and taxes. This formula is used when net earnings of the company are available along with interest expense and the tax levied on the company and paid by the company.

Operating Income = Net Earnings + Interest Expense + Tax

Examples of Operating Income Formula (With Excel Template)

Let's take an example to understand the calculation of Operating Income Formula in a better manner.

You can download this Operating Income Template here – Operating Income Template

Example #1

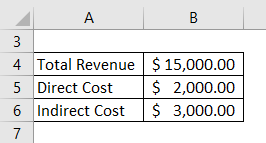

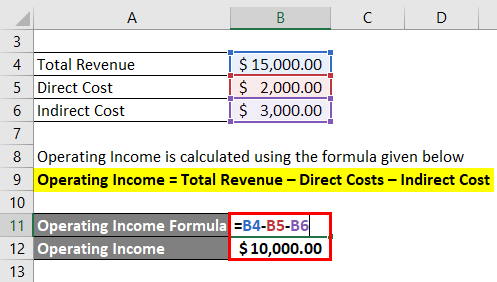

A company is having total revenue of $15,000, and a direct cost to the company is $2,000 and indirect cost to the company is $3000. Now, we have to calculate the Operating Income.

Solution:

Operating Income is calculated using the formula given below

Operating Income = Total Revenue – Direct Costs – Indirect Cost

- Operating Income = $15,000 – $2,000 – $3,000

- Operating Income = $10,000

So, the operating income of the company is $10,000.

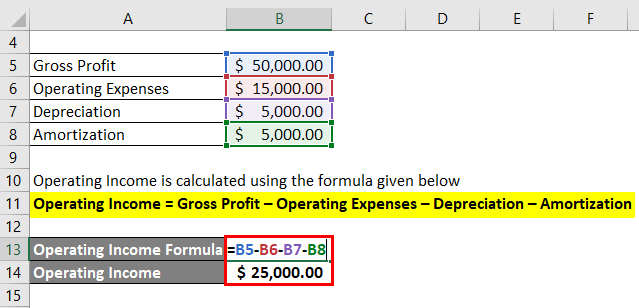

Example #2

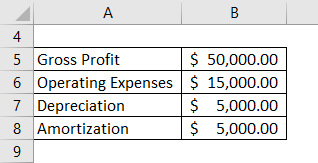

A company has a gross profit of $50,000 with an operating expense of $15,000, depreciation value of assets is $5,000 and amortization of $5,000. Calculate the value of Operating Income.

Solution:

Operating Income is calculated using the formula given below

Operating Income = Gross Profit – Operating Expenses – Depreciation – Amortization

- Operating Income = $50,000 – $15,000 – $5,000 – $5,000

- Operating Income = $ 25,000

So, the operating income of the company is $25,000.

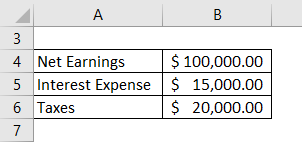

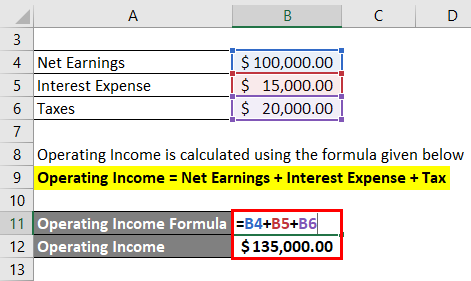

Example #3

A company has net earnings of $100,000 with interest expense of $15,000, and taxes of $20,000. Calculate the value of Operating Income.

Solution:

Operating Income is calculated using the formula given below

Operating Income = Net Earnings + Interest Expense + Tax

- Operating Income = $100,000 + $15,000 + $20,000

- Operating Income = $135,000

So, the operating income of the company is $135,000.

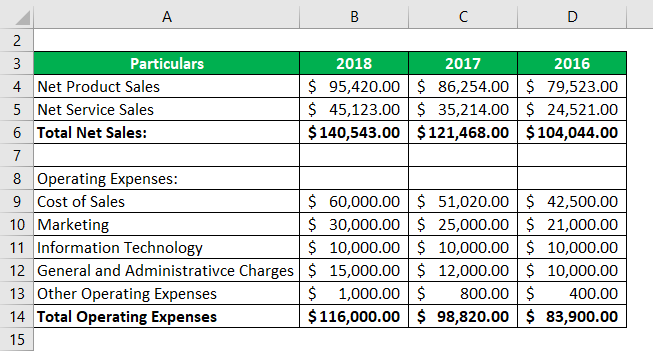

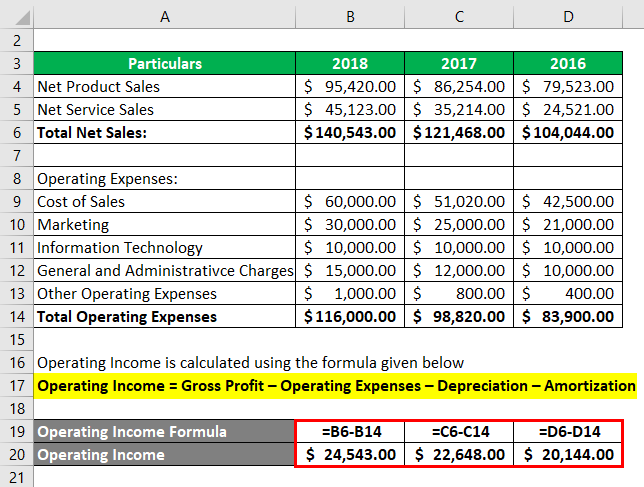

Example #4

A company named BNL Pvt. Ltd wants to calculate its operating income for the last 3 years.

Below is an income statement of the company for three years to calculate the Operating Income.

Solution:

Operating Income is calculated using the formula given below

Operating Income = Gross Profit – Operating Expenses – Depreciation – Amortization

Here, Depreciation = 0 and Amortization = 0

For 2018

- Operating Income = $140,543 – $116,000

- Operating Income = $24,543

For 2017

- Operating Income = 121,468 – 98,820

- Operating Income = $22,648

For 2016

- Operating Income = 104,044 – 83,900

- Operating Income = $20,144

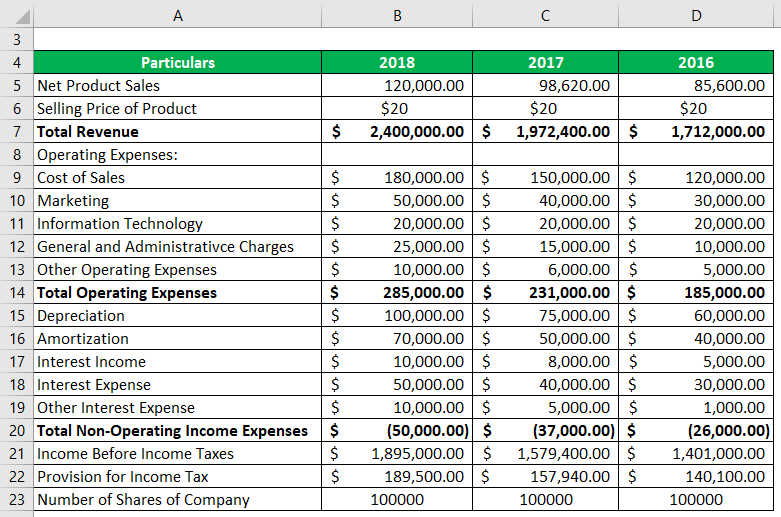

Example #5

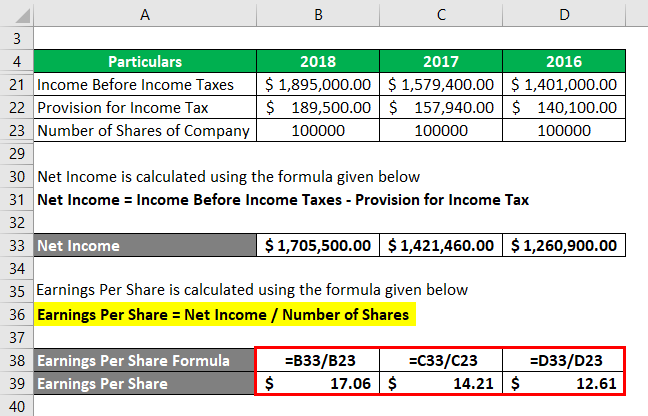

A manufacturing company named KML Manufacturer Pvt. Ltd wants to study its income statement for three years and wants to know the operating income and EPS through it.

Below are three-year income statements.

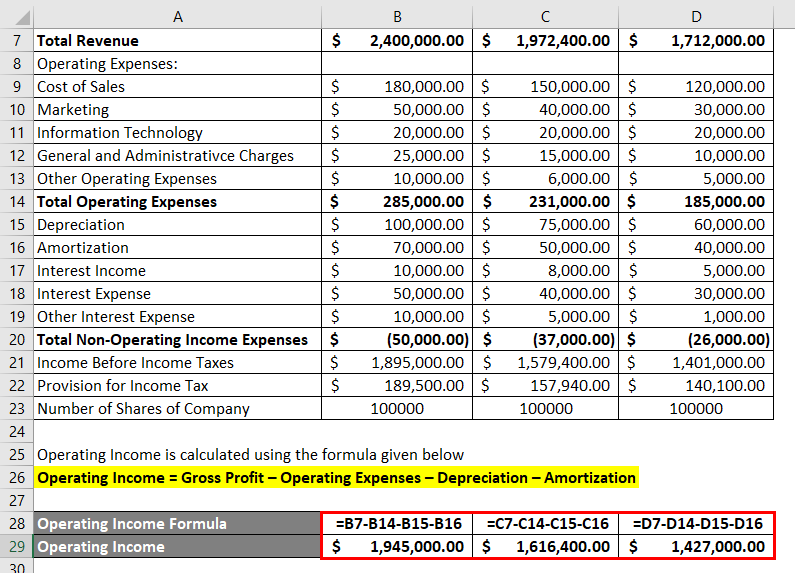

Solution:

Operating Income is calculated using the formula given below

Operating Income = Gross Profit – Operating Expenses – Depreciation – Amortization

For 2018

- Operating Income = $2,400,000 – $285,000 – $100,000 – $70,000

- Operating Income =$1,945,000

For 2017

- Operating Income = $1,972,400 – $231,000 – $75,000 – $50,000

- Operating Income =$1,616,400

For 2016

- Operating Income = $1,712,000 – $185,000 – $60,000 – $40,000

- Operating Income =$1,427,000

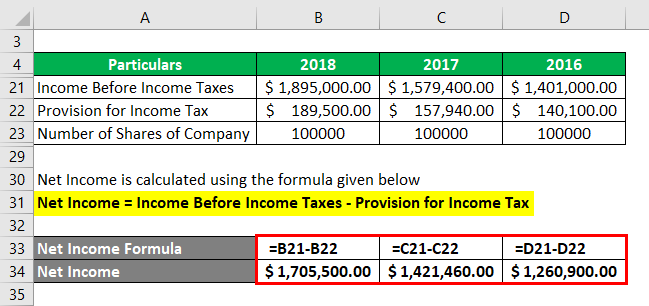

Net Income is calculated using the formula given below

Net Income = Income Before Income Taxes – Provision for Income Tax

For 2018

- Net Income = $1,895,000 – $189,500

- Net Income = $1,705,500

For 2017

- Net Income = $1,579,400 – $157,940

- Net Income = $1,421,460

For 2016

- Net Income in 2016 = $1,401,000– $140,100

- Net Income in 2016 = $1,260,900

Earnings Per Share is calculated using the formula given below

Earnings Per Share = Net Income / Number of Shares

For 2018

- Earnings Per Share in 2018 = $1,705,500 / $100,000

- Earnings Per Share in 2018 = $17.06

For 2017

- Earnings Per Share = $1,421,460/ $100,000

- Earnings Per Share = $14.21

For 2016

- Earnings Per Share in 2016 = $1,260,900/ $100,000

- Earnings Per Share in 2016 = $12.61

Explanation of Operating Income Formula

The operating income is gross profit or profit generated by company minus operating expense which includes selling general and administrative expenses, amortization, depreciation of assets, rent, salary of employees, insurance, commission, postage expense and supplies expense operating incomes do not include investment and non-operating income, taxes and interest expense hence in some formula where operating expense is used taxes are added in formula and while in another formula where gross profit is used operating expense is deducted from gross profit along with deduction of amortization and depreciation of assets from gross profit which results in operating income. And total revenue minus company paid the cost which can be direct cost or indirect cost to result in operating income.

Relevance and Uses of Operating Income Formula

There are many uses of operating income, they are as follows:

- Operating income is used to measure the efficiency of the company.

- It is used to find the profitability of the company.

- It shows the overall health of the company.

- Operating income helps in decision marking of the company.

- It helps to calculate EPS value.

Operating Income Formula Calculator

You can use the following Operating Income Formula Calculator

| Total Revenue | |

| Direct Costs | |

| Indirect Cost | |

| Operating Income Formula | |

| Operating Income Formula = | Total Revenue - Direct Costs - Indirect Cost | |

| 0 - 0 - 0 = | 0 |

Conclusion

Operating income tells about the financial condition of a company higher the operating income more profitable company will be and will able to pay the debt of the company on time. Investor monitor operating income as it gives the idea of the future scalability of the company. But some company's management misuse this and do fraud by changing the value of revenue and delaying expenses which is against GAAP principle of accounting.

Recommended Articles

This has been a guide to Operating Income Formula. Here we discuss how to calculate Operating Income along with practical examples. We also provide Operating Income calculator with downloadable excel template. You may also look at the following articles to learn more –

- Guide To Net Income Formula

- Example of Change in Net Working Capital Formula

- Formula For Market Capitalization

- Examples of Shareholders' Equity Formula

- How to Calculate Operating Ratio?

- Guide to Gross Income Formula

how to find operating income

Source: https://www.educba.com/operating-income-formula/

Posted by: villanuevalibler.blogspot.com

0 Response to "how to find operating income"

Post a Comment